BlackRock CEO: Conflict in Ukraine marks end of globalization

03/29/2022 / By Kevin Hughes

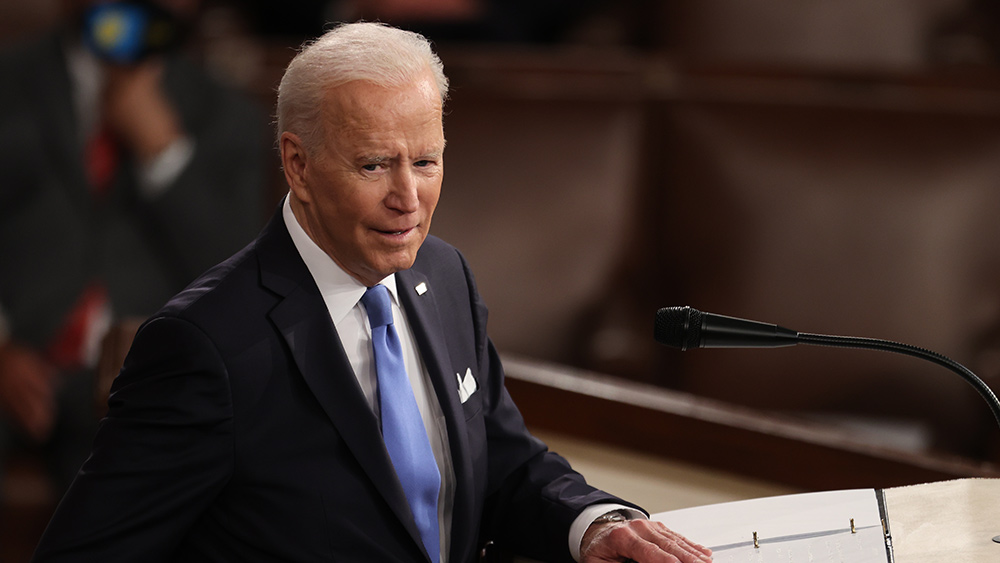

BlackRock CEO Larry Fink said that the conflict in Ukraine marks the end of globalization as governments and businesses sever ties with Russia. BlackRock, the world’s biggest asset manager, is a leading provider of investment, advisory and risk management solutions.

“The Russian invasion of Ukraine has put an end to the globalization we have experienced over the last three decades. United in their steadfast commitment to support the Ukrainian people, they launched an ‘economic war’ against Russia,” Fink stated in a March 24 memo to shareholders. (Related: GLOBAL SHOCKWAVE: Russia announces plans to ban commodity exports following Western sanctions.)

Fink has also warned that a widespread reorientation of supply chains will be inflationary.

Russia has been slapped with paralyzing sanctions over what it calls a “special military operation” in Ukraine. The actions have targeted Russian banks and wealthy oligarchs aside from the closure of airspace to Russian aircraft and the banning of exports coming from Russia.

Sanctions freeze $300 billion of Russia’s central bank reserves

The sanctions also involve a freeze on nearly $300 billion of Russia’s central bank hard currency reserves, an unprecedented move that Russian Foreign Minister Sergey Lavrov condemned on March 23 as “theft.”

Fink stated in his memo that capital markets, financial institutions and companies have surpassed government-imposed sanctions, moving swiftly to stop long-term business and investment relationships.

He indicated that Russia’s separation from the global economy will incite governments and companies to re-evaluate their manufacturing and assembly footsteps more commonly and review their reliance on other nations.

“This may lead companies to onshore or nearshore more of their operations, resulting in a faster pull back from some countries,” said Fink, who added that there will be challenges for firms as they seek to rework supply chains.

“This decoupling will inevitably create challenges for companies, including higher costs and margin pressures. While companies’ and consumers’ balance sheets are strong today, giving them more of a cushion to weather these difficulties, a large-scale reorientation of supply chains will inherently be inflationary.”

Central banks find themselves in a difficult moment, weighing how quick to increase rates in a bid to control rising inflation, which has been aggravated by the war in Ukraine and the ensuing energy price hikes. “Central banks must choose whether to live with higher inflation or slow economic activity and employment to lower inflation quickly,” Fink said.

The Federal Reserve during the past week raised rates for the first time since 2018 and Fed Chair Jerome Powell said on Monday, March 21, that the U.S. Central Bank must move “expeditiously” to increase rates and possibly “more aggressively” to keep a rising price spiral from becoming established.

Yearly inflation in Russia accelerated to 14.5 percent as of March 18, the quickest pace since 2015, the country’s Ministry of Economic Development said on March 23, as the beat-up ruble sent prices soaring amidst bitter Western sanctions.

Fink, whose firm manages more than $10 trillion, said BlackRock has also taken measures to delay the buying of any Russian securities in its active index portfolios.

“Over the past few weeks, I’ve spoken to countless stakeholders, including our clients and employees, who are all looking to understand what could be done to prevent capital from being deployed to Russia,” Fink said.

The CEO added that BlackRock is dedicated to watching the direct and indirect effects of the crisis, and designed to comprehend how to steer this new investment environment. “The money we manage belongs to our clients. And to serve them, we work to understand how changes around the world will impact their investment outcomes.”

Follow MarketCrash.news to know more about globalization.

Watch the video below to know why BlackRock CEO Larry Fink said the Ukraine War has put an end to globalization.

This video is from the In Search Of Truth channel on Brighteon.com.

More related stories:

Russian sanctions and oil embargoes to cause world’s biggest oil supply crisis by next month.

Russia warns Western firms supporting sanctions that they could face asset seizures, arrests.

Top shipping companies are suspending bookings to and from Russia.

Sources include:

Submit a correction >>

Tagged Under:

asset management, BlackRock, capital markets, central bank, financial system, globalization, Inflation, interest rates, international trade, Larry Fink, Russia, Russia-Ukraine war, shareholders, supply chains, Ukraine, WWIII

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS