FedEx cratering as economy implodes, shipping demand falls off cliff

09/20/2022 / By Ethan Huff

Things are not looking good for global shipping giant FedEx, which just announced the implementation of significant cost-cutting measures due to a “softness” in global shipping volume.

Softness, in this context, means that people and companies are no longer shipping things as much as they once were. This is, in part, due to ongoing supply chain problems and growing economic unrest, not to mention the escalating energy crisis in Europe.

This writer also speculates that covid “vaccination” and the associated mounting death toll may also play a role in the slowing circulation of consumer goods.

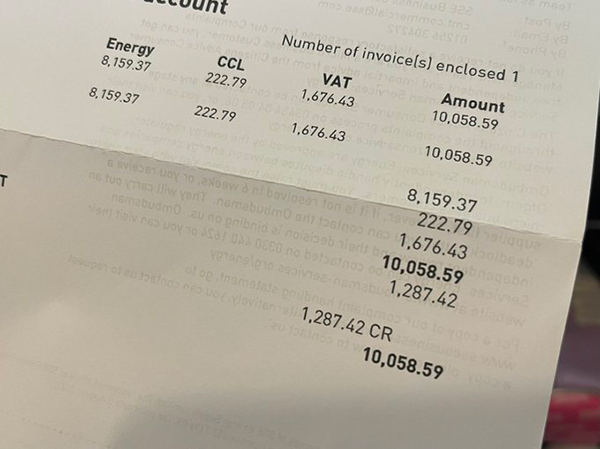

FedEx CEO Raj Subramaniam announced bleak preliminary earnings for the company, which sent its share price plummeting more than 20 percent by end of day last Friday, wiping around $11 billion from the company’s global market capitalization.

Late last Thursday, the shipping giant announced the withdrawal of its full-year guidance, as well as significant cost-cutting measures. These include the closure of 90 offices and five corporate locations, as well as deferred hiring.

“Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S.,” Subramaniam said. “While this performance is disappointing, we are aggressively accelerating cost reduction efforts.”

Subramaniam says he fully expects a “worldwide recession”

It says a lot when one of the most established logistics companies in the world is suffering to the degree it currently is – talk about a canary in a coalmine!

Subramaniam addressed this while speaking to CNBC‘s Jim Cramer of “Mad Money,” telling Cramer and viewers that he fully expects the economy to enter a “worldwide recession.”

“We are a reflection of everybody else’s business, especially the high-value economy in the world,” Subramaniam said.

That same day, the Dow Jones Industrial Average (DJIA) plummeted around 1,500 points – this following the previous week when U.S. equities had their worst day since the mini-crash of 2020 when the covid plandemic was launched.

After scrapping the announcement of its planned full-year forecast, FedEx indicated a reduced capital expenditure for the year of $500 million, bringing the total amount down to $6.3 billion.

Weakness in Asia as well as challenges in Europe linked to skyrocketing energy costs, the company indicated, are both factors in FedEx’s current plight. Shipping volume remains choked even as the company’s operating expenditures remain high.

Yahoo Finance editor-at-large Brian Sozzi is livid at Subramaniam for announcing the bad news before the company’s planned earnings announcement, calling it an “embarrassment.”

He railed the company on TikTok, stating that while the current economy is challenging, “that doesn’t entirely explain missing earnings estimates for a quarter by a couple of dollars and then withdrawing your full-year guidance.”

“Doing those things in this environment may be the norm at tech companies, but it shouldn’t be the norm at a company like FedEx,” Sozzi says.

Subramaniam is a new CEO, and his decision to do things the way he did represents a “black mark” on his reputation, added Argus Research president John Eade.

“It hurts on the guidance for sure,” he said.

It could take more than a year for investors to regain trust in FedEx, Sozzi lamented, explaining that he “wouldn’t be shocked” to see another activist swoop in again to demand “more aggressive change at FedEx, not unlike what we have seen at UPS under new best-in-class CEO Carol Tome.”

In terms of the broader market, Sozzi says, there are likely to be “more disasters like FedEx between now and November,” which just so happens to align with the upcoming midterm elections.

The latest news about the brewing implosion of the global economy can be found at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

canary, Collapse, dollar demise, earnings, economic crash, economy, energy crisis, Fedex, Inflation, market crash, national debt, pensions, Raj Subramaniam, recession, recession warning, shipping, supply chain

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS