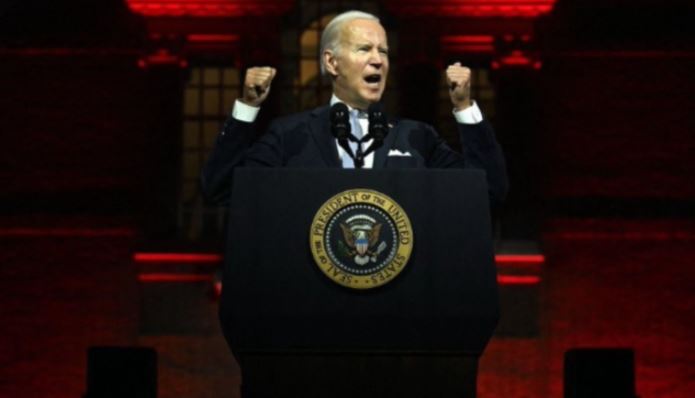

Nearly half of all Americans doing worse under Biden according to major new survey

02/10/2023 / By JD Heyes

Joe Biden, like other Democratic presidents before him, has not implemented great economic policies and, coupled with massive Democratic spending his first two years in office, has dramatically harmed the average American worker’s financial situation.

In fact, according to a major new survey, nearly half of all Americans say they are worse off thanks to “Bidenflation,” which makes you wonder why this president and his party did so well during the midterms.

“Since Gallup first asked this question in 1976, it has been rare for half or more of Americans to say they are worse off. The only other times this occurred was during the Great Recession era in 2008 and 2009,” Gallup News said in a report on the polling firm’s survey results. “Reflecting on their personal financial situations, 35% of Americans say they are better off now than they were a year ago, while 50% are worse off.”

On the other hand, today’s “better off” percentage is not unusually low, having descended to 35% or lower during other challenging economic times. This includes the late 1970s and early 1980s, the early 1990s, and from 2008 through 2012. In those periods, a higher percentage than today’s 14% volunteered that their finances were “the same” as last year.

All of these are periods of Democratic presidential terms. The late 1970s: Jimmy Carter (it took GOP President Ronald Reagan, who took office in January 1981, to turn around Carter’s poor economy); the early 1990s: Bill Clinton; 2008-2012: Barack Obama (and Biden as vice president).

Only Clinton would go on to have a decent economy and in fact, the country ran a budget surplus for a time during his two terms — but he was blessed with a Republican-controlled Congress that would not allow his policy excesses.

“The results of the survey, taken between January 2nd and the 22nd, suggest the high toll of inflation on the financial situation of many Americans. Average hourly and weekly wages declined for the second consecutive year in 2022, as pay increases were swamped by higher prices. Gallup said higher interest rates and the decline in the stock market also weighed on people’s view of their financial situation,” Breitbart News noted further, adding:

Although President Joe Biden has said his policies are designed to “build an economy from the bottom up and the middle out, not from the top down,” lower-income Americans are far more likely to report that they became worse off during the second year of the Biden administration. About 61 percent of households with incomes under $40,000 reported they were worse off, according to the Gallup survey. Just 26 reported they were better off.

This is a big jump from last year, when just 41 percent of lower-income Americans said they were worse off.

Inflation in the United States, already at 40-year highs, rose to an annual rate of 9.1 percent in June, the Department of Labor said. This is the highest rate since 1981. Compared with a month earlier, the Bureau of Labor Statistics’ Consumer Price Index was up 1.3 percent.

Economists had expected CPI to rise at an annual rate of 8.8 percent, up from 8.6 percent in May. They expected a month-over-month increase of 1.1 percent.

So-called “Bidenflation” has hit American families hard by raising prices for everyday necessities like food, gasoline, housing, transportation, and utilities. Huge increases in the price of gasoline in June, which hit new all-time highs several times during the month, started to sap household and business spending on other items.

Inflation has fallen from last summer’s highs, but it is still elevated: According to the Labor Department, the current inflation rate stands at 6.45 percent — more than double the long-term average of around 3.27 percent. And it’s not likely to improve much in the coming months.

Sources include:

Submit a correction >>

Tagged Under:

american workers, Biden regime, Bidenflation, big government, Collapse, consumer price index, democrats, Inflation, inflation rate, Joe Biden, Labor Dept., lower income, national debt, pensions, poverty, risk, supply chain, workers

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS