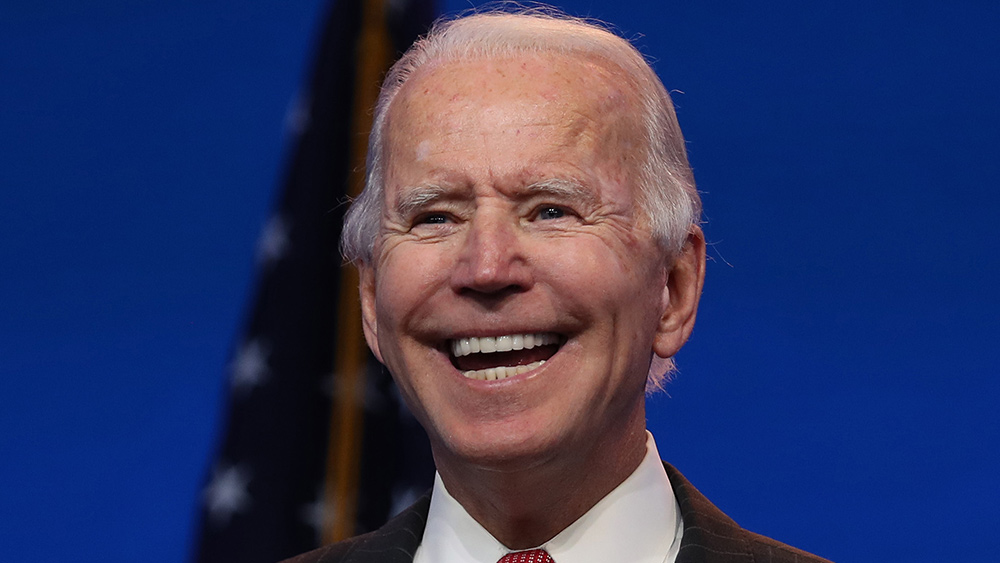

Biden admin to WIPE OUT $1.2B in federal student loans under new plan – essentially vote-buying using taxpayer money

02/27/2024 / By Laura Harris

The Department of Education (ED) has announced the automatic discharge of $1.2 billion in federal student loan debt for 153,000 borrowers under a new income-driven repayment (IDR) plan from President Joe Biden.

The Saving on A Valuable Education (SAVE) Plan seeks to provide relief to enrolled borrowers who have diligently made payments for at least 10 years and initially borrowed $12,000 or less for their college education. Under this plan, borrowers receive debt discharge after 20 or 25 years, depending on whether they have loans for graduate school. It also allows for additional debt discharge for every $1,000 borrowed above the $12,000 threshold, with borrowers being eligible after an extra year of payments.

Similar to previous IDR programs, SAVE adjusts monthly payments based on the income and family size of the borrower. But under this new plan, the ED will consider the age, income, disabilities and typical income of graduates to determine their eligibility for remaining balance discharge.

The department nevertheless assured that those meeting the eligibility criteria for forgiveness under the SAVE Plan will have their loans automatically discharged, requiring no action on their part. James Kvaal, undersecretary of education, said the new plan seeks to provide debt relief for borrowers facing hardships in their lives.

“The ideas we are outlining today will allow us to help struggling borrowers who are experiencing hardships in their lives,” said Kvaal. “They are part of President Biden’s overall plan to give breathing room to as many student loan borrowers as possible.”

Biden using student loan forgiveness to win votes

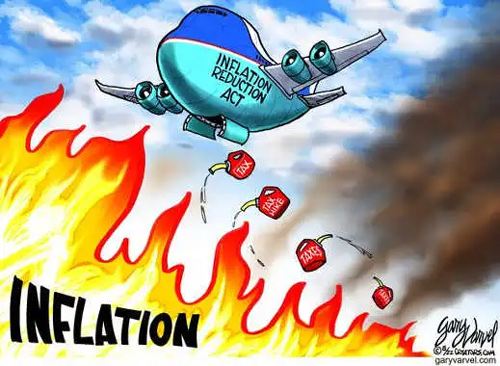

The Biden administration has been canceling federal student loan debt over the past few years. But some have criticized this move as a bid by the incumbent to curry favor with a voter base that is slowly abandoning him.

In 2023, Biden tasked the ED with crafting a new plan on a more solid legal basis, necessitating a longer and more complex process called “negotiated rule-making” after the Supreme Court rejected the initial $430 billion plan last summer. (Related: Biden defies Supreme Court on student debt cancellation, absurdly claims there’s no cost to taxpayers.)

In a 6-3 decision in June 2023, the high court threw a wrench in Biden’s plans to cancel student debt at the expense of hard-working taxpayers. The president nevertheless insisted that his debt relief plan would continue, regardless of the ruling.

“I promised we’d help eliminate accumulated student debt that millions of Americans carried during the economic pandemic and beyond,” Biden told his followers during a recent campaign stop in Las Vegas. “The Supreme Court of the U.S. blocked me, but they didn’t stop me.”

Republican presidential candidates have voiced opposition to the student debt forgiveness plan. Former President Donald Trump, the front-runner for the GOP nomination, blasted the plan following the Supreme Court’s decision. Canceling student debt, he argued, “would have been very unfair to the millions and millions of people who paid their debt through hard work and diligence.”

Former South Carolina Gov. Nikki Haley, Trump’s lone rival for the GOP nomination, echoed the sentiments of her former boss. She remarked that canceling student debt is unfair for those who worked hard to pay back their loans or make other career choices that didn’t involve going deep into debt. Haley served as the U.S. ambassador to the United Nations during Trump’s term.

Visit DebtCollapse.com for more stories about student loans.

Watch this clip from One America News covering President Joe Biden’s latest announcement of more student loan forgiveness measures.

This video is from the NewsClips channel on Brighteon.com.

More related stories:

DEBT REVOLUTION? Tens of millions of student loan borrowers stage “massive student debt strike.”

Dave Blaze calls for end to the STUDENT LOAN racket.

Taxpayer money going down the drain: Biden circumvents SC decision, cancels $72M in student debt.

HYPOCRITES: Florida Dem running for senator who wants her student loans forgiven OWNS A $3M MANSION.

Sources include:

Submit a correction >>

Tagged Under:

big government, debt bomb, debt collapse, debt discharge, debt forgiveness, Department of Education, education system, finance riot, government debt, insanity, Joe Biden, loan forgiveness, money supply, national debt, public education, SAVE Plan, Saving on A Valuable Education, student debt, student loan, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS