Deep recession all but assured now after latest Fed rate hike

09/26/2022 / By JD Heyes

Despite the fact that the U.S. economy contracted for two straight quarters this year under Bidenflation, the historic definition of a recession, the regime changed the rules of the game and claimed that no, that’s not the real definition.

At the same time, the garbage media played its role and went along, promulgating the lie in an attempt to save Democrats a butt-kicking in the November midterms.

Meanwhile, thanks to Democratic economic policies of trying to spend our way out of an inflationary cycle, that has only made inflation worse, leaving the Federal Reserve no choice but to essentially kill the economy in order to force prices to fall.

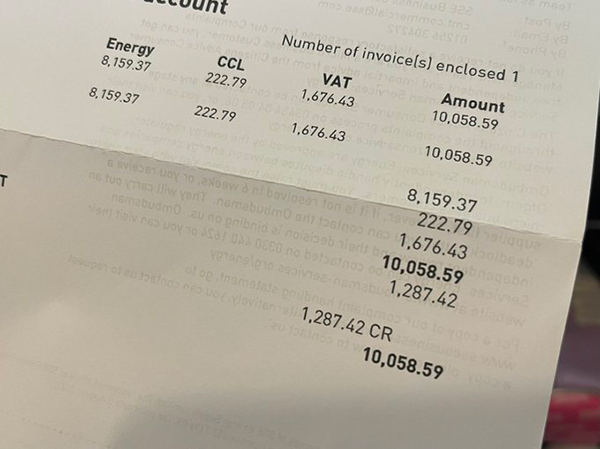

Even as interest rates are their highest in years thanks to a series of Fed rate hikes, inflation has continued to plague Americans — again, because Democrats in power are engaged in inflationary spending policies. So, on Wednesday, Federal Reserve Chairman Jerome Powell announced another rate hike — .75 percent — which will make home, auto and building loans even higher than they already are. The new hike will lead to major declines in purchases of those items, which will, in turn, lead to a recession so deep there won’t be any way the regime and its media lackeys can deny that one exists.

CNBC notes further:

The Fed’s interest rate projections caught some traders by surprise, in that they were much more hawkish for longer than many in the market expected.

Prior to the announcement, fed funds futures were pricing a target rate of 4.51 for fed funds after the March 2023 meeting. The Fed’s so-called “dot plot” released Wednesday shows a peak 4.6% in 2023.

“It’s really hawkish,” John Briggs of NatWest Markets told the outlet, adding that the median rates are much higher than expected. “Basically they’re saying it’s front-loaded but they are staying restrictive all the way through 2025.”

“They’re basically saying rates have to go higher and faster and even if we have cuts in ’24 and ’25, they’re still going to stay restrictive into 2025. You don’t have them getting back to neutral until 2025. It’s pretty hawkish. It’s three years of tight policy,” he added.

And three years, at least, of recession.

“I think that shelter inflation is going to remain high for some time. We’re looking for it to come down, but it’s not exactly clear when that will happen. It may take some time. Hope for the best, plan for the worst,” Powell said, essentially noting that prices are going to remain high for some time and so, interest rates must in order to counter the inflation.

“Our expectation has been we would begin to see inflation come down, largely because of supply-side healing,” he added. “We haven’t. We have seen some supply side healing, but inflation has not really come down. We need to continue, and we did today do another large increase as we approach the level we think we need to get to. We’re still discovering what that level is.”

Bill Zox, portfolio manager at Brandywine Global, said: “I believe 75 is the new 25 until something breaks, and nothing has broken yet. The Fed is not anywhere close to a pause or a pivot. They are laser-focused on breaking inflation. A key question is what else might they break.”

“No one knows whether this process will lead to a recession or, if so, how significant that recession would be,” Powell added during a news conference. “That’s going to depend on how quickly wage and price inflation pressures come down, whether expectations remain anchored and also if we get more labor supply.”

In fact, we are already in a recession. And as long as inflation continues — which it will — then rate hikes will go as high as need be to kill consumer demand. Expect major economic problems ahead combined with layoffs and, likely, business closures, just the opposite of what the country experienced during Donald Trump’s term.

Sources include:

Submit a correction >>

Tagged Under:

Bidenflation, currency crash, dollar demise, economic collapse, economy, Inflation, Jerome Powell, money supply, pensions, rate hike, recession, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS