As the economy implodes, credit card balances are increasing at the fastest pace in U.S. history

02/21/2023 / By News Editors

When the going gets tough, it can be extremely tempting to pile on debt as a solution. The cost of living is rising much faster than most of our paychecks are, and this is putting an enormous amount of financial stress on hard working Americans. But rather than cutting back on spending, a lot of people are choosing to deal with that financial stress by going into more debt. In fact, we just learned that U.S. household debt reached an all-time record high of 16.9 trillion dollars last quarter…

(Article by Michael republished from TheEconomicCollapseBlog.com)

Total US household debt hit a record $16.9 trillion during the fourth quarter, an increase of $394 billion, or 2.4%, from the prior three-month period, according to the Fed’s latest Quarterly Report on Household Debt and Credit. While the lion’s share of the debt is attributable to mortgages, the report showed that not only are credit card balances swelling at record levels, delinquencies are on the rise as well.

In particular, Americans are turning to credit card debt like never before.

According to CNN, in the fourth quarter credit card debt in the United States increased at the fastest pace ever recorded…

Credit card balances increased nearly 6.6% to $986 billion during the quarter, the highest quarterly growth on record, according to New York Fed data that goes back to 1999. Year over year, credit card balances grew 15.2%.

This is not a good idea.

When the economy is slowing down, going deeper into debt is one of the worst financial mistakes that you can make.

But millions of Americans are doing it anyway.

It is inevitable that lots of them will ultimately get behind on their payments, and the latest numbers show that this is already starting to happen…

The share of credit card users making payments that were at least 30 days late, also known as early delinquencies, rose last quarter to 5.9% from 5.2% in the prior quarter. The share of serious credit card delinquencies, which represents payments that are 90 or more days late, rose to 4% last quarter from 3.7% in the prior quarter.

The New York Fed is telling us that a whopping 18.3 million Americans were behind on their credit card payments at the end of 2022.

At the end of 2019, that number was sitting at just 15.8 million.

Things are definitely moving in a very troubling direction.

Unfortunately, many Americans have little choice at this point. Approximately two-thirds of the country is living paycheck to paycheck, and now a lot of us are being swamped by bills that we simply cannot afford to pay.

For example, one homeowner in California was absolutely horrified when he was hit by a $907.13 utility bill…

Brent Eldridge had heard that prices for natural gas were high this winter, but nothing prepared him for how bad it could be.

When he opened the envelope from Long Beach’s utility department, he couldn’t believe the total: $907.13, nearly eight times higher than his bill at the same time last year.

“It made me want to puke,” said Eldridge, 48, a pastor.

Millions of others are being slammed by similar bills this winter.

Meanwhile, the price of food continues to soar to ridiculous heights.

Sadly, food prices will not be returning to where they once were, and so we are being told that the solution is to literally eat less food. Earlier this week, the Wall Street Journal actually posted an article entitled “To Save Money, Maybe You Should Skip Breakfast”.

Skipping meals to make ends meet?

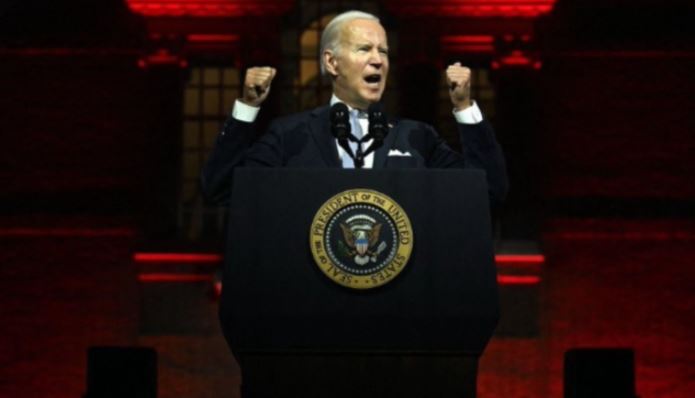

This is how badly Biden’s economy is beating down average Americans.https://t.co/WJegLYW5UN

— John Kennedy (@SenJohnKennedy) February 15, 2023

This is where we are at.

The reckless policies of our leaders created this inflation crisis, and we are all suffering as a result.

Read more at: TheEconomicCollapseBlog.com

Submit a correction >>

Tagged Under:

Bubble, Collapse, credit card, crisis, debt bomb, debt collapse, economy, finance, food inflation, government debt, household debt, Inflation, market crash, money supply, national debt, risk, US

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS