US could default on its debt by July if deal on raising the debt ceiling is not reached

02/21/2023 / By Arsenio Toledo

The Congressional Budget Office (CBO) has warned that the United States could default on its national debt if Congress and the White House are unable to agree on raising the debt ceiling.

The current debt ceiling is $31.4 trillion. The U.S. is expected to reach this limit sometime between July and September, according to the CBO’s projections. For now, the Department of the Treasury is working overtime deploying a series of special accounting maneuvers, referred to as “extraordinary measures” by the CBO, to make sure the government can keep paying its obligations, such as to bondholders and to Social Security recipients.

“If the debt limit is not raised or suspended before the extraordinary measures are exhausted, the government would be unable to pay its obligations fully,” the CBO’s report stated. “As a result, the government would have to delay making payments for some activities, default on its debt obligations, or both.”

The CBO noted that the final date for when the U.S. will reach the debt ceiling will be determined by tax revenues received by the Internal Revenue Service in April. Should these revenues decline significantly from the CBO’s own estimates, the extraordinary measures “could be exhausted sooner, and Treasury could run out of funds before July,” noted CBO Director Phillip Swagel. (Related: To increase or not to increase: Republicans and Democrats clash over $31.4 trillion debt ceiling.)

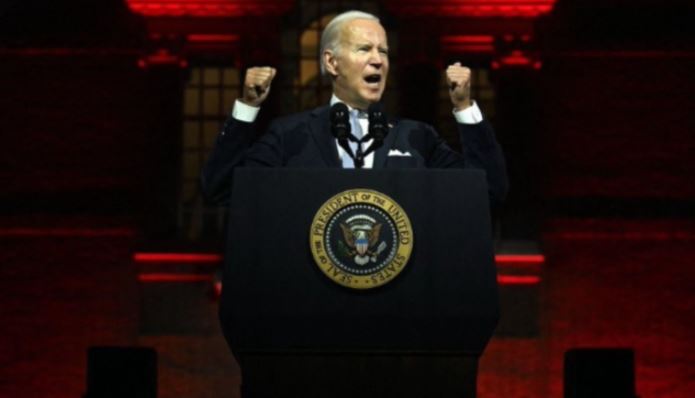

Biden, Republicans at an impasse over raising debt ceiling

Republicans, who recently took control of the House of Representatives, are now demanding concessions from President Joe Biden’s Democratic administration before they agree to raise the debt limit this year.

The GOP is demanding that any legislation raising the debt limit must be accompanied by cuts in federal spending. But both the White House and Democrats in Congress have rejected any possibility of spending cuts, arguing that the debt limit should be raised without any conditions.

House Speaker Kevin McCarthy noted that he is concerned with the amount the federal government spends to service its debt and said the projected increases in these costs meant that Congress needed to rein in spending.

“A blank check for more spending will destroy our country,” he wrote. “That’s why we must negotiate a responsible debt limit increase that gets our fiscal house back in order.”

Biden, meanwhile, has accused the Republican Party of “talking about taking the economy hostage” with its refusal to increase the debt ceiling without any conditions. Speaking at a union hall in Maryland on Wednesday, Feb. 15, Biden said: “I will not negotiate over whether or not we pay our debt.”

He added that he would not allow the U.S. to default. “[Republicans have] no business playing politics with people’s lives and the full faith and credit of the United States,” he said.

Despite the current impasse, both top Republican and Democratic officials have repeatedly assured the public that the U.S. will not default on its debt and that they will reach some kind of agreement on the ceiling in time to avert a crisis. But what this agreement will look like is anybody’s guess.

Learn more about America’s debt situation at DebtBomb.news.

Watch this clip from “Rob Schmitt Tonight” on Newsmax covering the coming showdown over the debt ceiling.

This video is from the News Clips channel on Brighteon.com.

More related stories:

NY Rep. Tenney: Biden should slash federal spending amid debt ceiling battle.

Economists: Over $31 trillion national debt could lead to slow-moving economic demise.

US national debt hits $31 TRILLION for the first time.

David Stockman on America’s debt palooza… From $1 trillion to $30 trillion in a heartbeat.

Nearly half of all Americans doing worse under Biden according to major new survey.

Sources include:

Submit a correction >>

Tagged Under:

big government, cancel Democrats, Congress, Congressional Budget Office, debt, debt bomb, debt ceiling, debt collapse, debt default, debt limit, dollar demise, government debt, government waste, Inflation, Joe Biden, Kevin McCarthy, market crash, money supply, national debt, pensions, Republicans, risk, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 NATIONAL DEBT NEWS